Inflation’s Impact on Business Costs: Mitigation Strategies

Advertisements

Navigating the complexities of inflation is paramount for business longevity and growth, necessitating a deep understanding of its cost implications and the development of proactive mitigation strategies to ensure financial stability.

Advertisements

The persistent challenge of inflation casts a long shadow over businesses globally, intricately weaving itself into every facet of operational finance. For many, understanding the nuances of how rising prices translate into increased expenditures is the first, crucial step toward resilience. This article explores the profound impact of inflation on business costs and delineates pragmatic strategies for mitigation, offering insights that aim to fortify your enterprise against economic shifts.

Advertisements

The Anatomy of Inflation: Understanding Its Effects on Business Expenditures

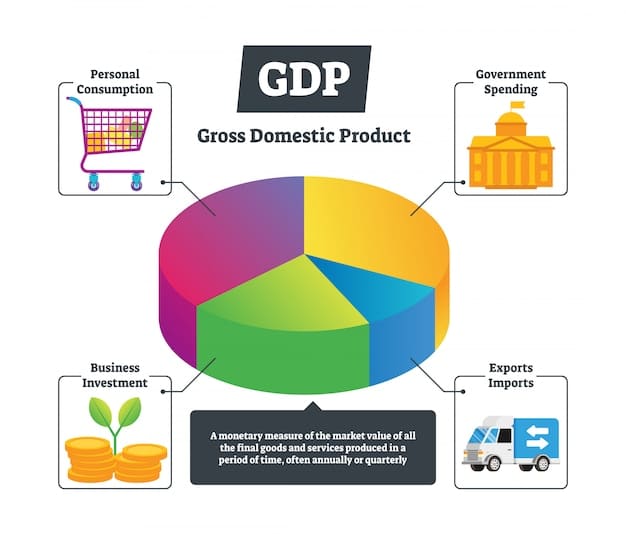

Inflation, at its core, represents a general increase in prices and fall in the purchasing value of money. While often discussed in macroeconomic terms, its impact reverberates directly and intimately within the balance sheets of individual businesses. For enterprises, this means a consistent erosion of profitability margins if not adequately addressed.

Direct Cost Pressures

The most immediate and visible effect of inflation on businesses is the escalation of direct costs. These are the expenses directly attributable to the production of goods or services. Consider raw materials, for instance. As inflationary pressures mount, the cost of steel, lumber, oil, or agricultural products can surge, directly impacting manufacturing and supply chains.

- Raw Material Price Increases: This is often the first domino to fall. Suppliers face their own rising costs, passing them down the chain.

- Labor Cost Escalation: Employees demand higher wages to maintain purchasing power, leading to increased payroll expenses.

- Transportation and Logistics: Fuel prices fluctuate, and the overall cost of moving goods becomes more expensive.

- Utility Bills: Energy costs, covering electricity, gas, and water, often rise in tandem with inflation.

Beyond these, indirect costs also feel the pinch. Rent for office or factory space, insurance premiums, and the cost of capital can all experience inflationary pressure, making it more expensive to simply exist as a business. The cumulative effect can be overwhelming, potentially pushing even well-established companies into precarious positions without strategic cost controls.

In essence, inflation doesn’t just erode consumer purchasing power; it systematically eats away at a company’s financial resilience, demanding agile responses and a proactive approach to cost management. The challenge lies in anticipating these shifts and implementing measures before they become critical threats to stability.

Supplier Relationships and Supply Chain Resilience in an Inflationary Environment

The intricate web of supplier relationships forms the backbone of any business operation. In an inflationary climate, the stability and strength of these relationships become even more critical. Businesses must navigate price increases from suppliers while simultaneously ensuring the continuity and reliability of their supply chains. This requires a delicate balance of negotiation, strategic partnership, and often, diversification.

Supplier price hikes are a direct consequence of their own escalating costs, from raw materials to labor and transportation. Businesses, therefore, must develop sophisticated strategies to mitigate these increases without compromising the quality or availability of essential inputs.

Negotiation and Contract Management

Effective negotiation with suppliers is paramount. This isn’t just about demanding lower prices; it involves understanding their cost structures, exploring long-term contracts with fixed pricing where possible, and seeking volume discounts. Building trust and a collaborative environment can lead to mutually beneficial arrangements, even in times of economic uncertainty.

- Long-term Contracts: Securing agreements that lock in prices for an extended period can provide much-needed stability.

- Volume Discounts: Consolidating purchases with fewer suppliers to achieve better pricing.

- Escalation Clauses: Negotiating fair terms for price adjustments in contracts based on pre-defined economic indicators.

Beyond negotiation, businesses should consider diversifying their supplier base. Relying on a single supplier, even a trusted one, can expose a company to significant risks if that supplier faces inflationary pressures or supply disruptions. Diversification can provide alternative sources, fostering competition and reducing dependency.

Moreover, businesses are increasingly finding value in localized sourcing. While global supply chains often offer cost advantages in stable times, local suppliers can reduce transportation costs, shorten lead times, and potentially offer greater flexibility in a volatile economic landscape. This shift also aligns with growing trends toward sustainability and supporting local economies.

The goal is to transform supplier relationships from transactional exchanges into strategic partnerships, where both parties work together to absorb or mitigate inflationary pressures, ensuring the continued flow of goods and services at manageable costs.

Labor Costs and Workforce Management Under Inflation

One of the most persistent and sensitive areas impacted by inflation is labor costs. As the cost of living rises, employees naturally seek wage increases to maintain their purchasing power. For businesses, this translates into higher payroll expenses, which can significantly dent profitability if not managed strategically. Navigating this challenge requires a nuanced approach that balances economic realities with employee well-being and retention.

The demand for higher wages is a direct response to rising inflation. If wages do not keep pace with the cost of living, employee morale can plummet, leading to decreased productivity, higher turnover rates, and difficulty in attracting new talent. This creates a challenging dilemma for businesses: absorb higher labor costs or risk losing valuable employees.

Wage Adjustments and Benefits

While across-the-board wage increases might seem like the most straightforward solution, they are not always financially feasible for every business. Instead, consider a more strategic approach to compensation and benefits. This could involve performance-based bonuses, inflation-adjusted stipends for essential expenses, or enhanced non-monetary benefits that add real value to an employee’s life without directly increasing the baseline wage significantly.

- Targeted Wage Adjustments: Focus raises on critical roles or top performers to retain key talent.

- Benefit Enhancements: Offer improved health benefits, retirement plans, or professional development opportunities.

- Flexible Work Arrangements: Providing flexibility can be a valuable non-monetary perk that boosts morale and retention.

Furthermore, businesses should explore strategies to improve labor efficiency. This might involve investing in automation, streamlining processes, or providing additional training to enhance employee productivity. A more efficient workforce can offset some of the inflationary pressures on wages by producing more output with the same or fewer resources.

Finally, fostering a positive work environment, promoting work-life balance, and investing in employee growth can significantly contribute to retention. When employees feel valued and supported, they are often more resilient to external economic pressures and less likely to seek opportunities elsewhere solely based on slightly higher pay. The key is to manage labor costs proactively, recognizing that a stable and motivated workforce is a critical asset in any economic climate.

Operational Efficiency and Technology Investment as Inflation Mitigation Tools

In the face of rising costs, businesses must aggressively pursue greater operational efficiency and strategically leverage technology. These two areas are powerful allies in mitigating the adverse effects of inflation, allowing companies to do more with less, reduce waste, and streamline processes. The goal is to maximize output while minimizing input costs, thereby protecting profit margins.

Operational efficiency goes beyond mere cost-cutting; it involves a fundamental re-evaluation of how tasks are performed, resources are utilized, and value is delivered. It’s about optimizing every step of the business process to eliminate redundancies, reduce waste, and improve productivity. For example, analyzing workflows can reveal bottlenecks or inefficiencies that, once addressed, can significantly lower operational expenses.

Leveraging Technology for Cost Reduction

Technology plays a transformative role in achieving these efficiencies. Automation, for instance, can reduce the need for manual labor in repetitive tasks, freeing up human resources for more strategic activities and potentially lowering overall labor costs. Cloud-based solutions can eliminate the need for expensive on-site IT infrastructure, offering scalable and cost-effective alternatives.

- Process Automation: Automating repetitive tasks across various departments to reduce labor hours.

- Cloud Computing: Migrating to cloud services to lower infrastructure costs and enhance scalability.

- Data Analytics: Utilizing data to identify areas of waste, optimize inventory, and improve decision-making.

- Energy-Efficient Tech: Investing in equipment that consumes less power to reduce utility bills.

Moreover, robust data analytics tools can provide invaluable insights into cost drivers, inventory levels, and customer behavior. By understanding these dynamics, businesses can make more informed decisions about purchasing, pricing, and resource allocation, leading to significant savings. Predictive analytics, for example, can help anticipate future demand, allowing for just-in-time inventory management that reduces holding costs and spoilage.

Investing in energy-efficient machinery and practices can also yield substantial cost savings, especially as utility prices are often susceptible to inflationary pressures. From LED lighting to modern HVAC systems, these investments, while initially costly, often provide rapid returns through reduced energy consumption.

Ultimately, a continuous focus on efficiency and a willingness to embrace technological advancements are not just reactive measures against inflation but fundamental pillars of long-term business resilience and competitiveness.

Pricing Strategies and Customer Relations in an Inflationary Economy

When inflation hits, businesses face the difficult decision of how to adjust their pricing. Raising prices is often a necessary step to cover increased costs, but it comes with the risk of scaring away customers and losing market share. Therefore, a careful and strategic approach to pricing, coupled with strong customer relations, is essential to navigate an inflationary economy successfully.

The impulse might be to simply pass on all increased costs to the consumer. However, this can backfire if competitors are more adept at managing their costs or if the market is particularly price-sensitive. Consumers are also feeling the pinch of inflation, and their purchasing power is diminished, making them more discerning about their spending.

Dynamic Pricing and Value Communication

Instead of blanket price increases, businesses should consider dynamic pricing models that allow for flexibility based on market demand, competitor pricing, and cost fluctuations. This involves analyzing product elasticity and understanding which products or services can bear higher prices without significantly impacting demand. Value-based pricing, where prices are set based on the perceived value to the customer rather than just cost-plus, can also be effective if the product or service offers clear advantages.

- Value-Based Pricing: Focus on the unique benefits and superior quality to justify price points.

- Bundling: Offer product bundles or tiered services to provide more perceived value for money.

- Smaller Sizes/Quantity: Adjusting product size or quantity to mitigate visible price increases (shrinkflation).

Crucially, effective communication with customers about price adjustments is vital. Transparency, explaining the reasons behind price increases (e.g., rising raw material costs, supply chain disruptions), can help maintain trust and understanding. Focus on emphasizing the continued value and quality of your offerings, reassuring customers that they are still getting a fair deal despite the higher price.

Moreover, strengthening customer relationships through excellent service, loyalty programs, and personalized communication can create a buffer against price sensitivity. Loyal customers are often more willing to tolerate minor price increases from brands they trust and value. Investing in customer retention also makes good business sense, as acquiring new customers is considerably more expensive than retaining existing ones.

In essence, pricing strategies during inflation demand a holistic approach, blending financial necessity with an unwavering commitment to customer satisfaction and clear, empathetic communication.

Financial Planning and Capital Management for Inflationary Times

Effective financial planning and astute capital management are arguably the most critical defensive mechanisms for businesses confronting inflation. Without a clear understanding of cash flow, liquidity, and strategic investment, even otherwise healthy companies can find themselves struggling to maintain operations or seize growth opportunities. This section delves into proactive financial strategies to safeguard a business’s fiscal health amidst rising prices.

Inflation erodes the purchasing power of money, meaning that the value of cash holdings decreases over time. For businesses, this translates into a need for greater working capital to finance the same level of operations and investments. Traditional financial models may not adequately account for these shifts, necessitating a re-evaluation of budget assumptions and forecasts.

Cash Flow Forecasting and Hedging

Rigorous cash flow forecasting becomes indispensable. Businesses must accurately predict their ins and outs of cash, accounting for inflationary impacts on both revenues (if prices are raised) and expenses. This helps identify potential liquidity shortfalls before they become critical, allowing for proactive measures like securing lines of credit or delaying non-essential expenditures.

- Enhanced Cash Flow Projections: Update forecasts frequently to reflect real-time inflationary changes.

- Inflation Indexing: Consider indexing contracts where possible, to adjust for inflation automatically.

- Strategic Hedging: Explore financial instruments to hedge against commodity price fluctuations where applicable.

Beyond forecasting, managing working capital efficiently is vital. This involves optimizing inventory levels (avoiding excessive stock that ties up capital but also ensuring sufficient buffer against supply shocks), managing accounts receivable to ensure prompt payments, and extending accounts payable without damaging supplier relationships. The goal is to keep cash circulating efficiently within the business.

For businesses with international operations or significant foreign currency transactions, hedging strategies may become more important. Fluctuations in exchange rates, often exacerbated by inflationary pressures in different economies, can impact the cost of imports and the value of exports. Financial instruments like forward contracts or options can help mitigate these currency risks.

Finally, businesses should carefully evaluate their debt. While inflation can erode the real value of fixed-rate debt (making it easier to repay), floating-rate debt can become more expensive as central banks raise interest rates to combat inflation. Strategic debt management, including refinancing or restructuring, might be necessary to control financing costs.

In essence, robust financial planning in an inflationary environment is about vigilance, foresight, and flexibility, ensuring that the business has the necessary liquidity and capital structure to withstand economic headwinds.

Long-Term Growth and Innovation in an Inflated Market

While much of the focus during inflationary periods is on short-term survival and cost mitigation, savvy businesses also recognize the importance of maintaining an eye on long-term growth and fostering innovation. An inflationary environment, despite its challenges, can paradoxically present opportunities for companies agile enough to adapt and innovate, potentially widening their competitive moat.

The temptation in an economic downturn or inflationary surge is often to cut back on research and development, marketing, and expansion plans. However, indiscriminately halting such investments can stifle future growth and leave a business vulnerable once the economic climate improves. Instead, businesses should strategically evaluate where innovation can offer the highest leverage against rising costs and evolving customer needs.

Strategic R&D and Market Diversification

Investing in research and development (R&D) that focuses on process improvements or the creation of more cost-efficient products can be particularly beneficial. For example, developing a new material that is cheaper to source or a manufacturing process that uses less energy can directly counteract inflationary pressures. Similarly, innovation in product design that enhances durability or functionality can justify higher prices to consumers looking for long-term value.

- Product Innovation: Develop new, more cost-efficient products or services that appeal to value-conscious consumers.

- Process Improvement via R&D: Invest in R&D to find cheaper materials or more efficient production methods.

- Market Diversification: Explore new markets or customer segments that may be less sensitive to price increases.

- Brand Building: Strengthen brand loyalty through consistent value and communication to retain customer base.

Consider also market diversification. While the primary market might be struggling with reduced consumer spending due to inflation, other segments or even international markets might present more stable or lucrative opportunities. This requires careful market analysis and a willingness to pivot where necessary, but it can open new revenue streams that are less exposed to domestic inflationary pressures.

Furthermore, strong brand building and differentiation become even more critical during inflationary times. When consumers are making more careful purchasing decisions, a strong brand that communicates clear value, quality, and trust can command loyalty and potentially absorb price increases better than commoditized products. This involves consistent marketing, excellent customer service, and a clear brand message that resonates with the target audience.

Ultimately, long-term success amidst inflation is not just about hunkering down; it’s about strategic maneuvering, embracing sensible innovation, and building enduring value that transcends temporary economic turbulences. Those who continue to innovate thoughtfully are often the ones who emerge stronger from challenging periods.

| Key Area | Mitigation Strategy Summary |

|---|---|

| 📈 Cost Control | Focus on direct costs like raw materials and labor through negotiation and efficiency gains. |

| 🔗 Supply Chain | Diversify suppliers, build stronger relationships, and explore localized sourcing. |

| ⚙️ Operations & Tech | Invest in automation and data analytics to streamline processes and boost productivity. |

| 💰 Financial Health | Strengthen cash flow forecasting and strategically manage working capital and debt. |

Frequently Asked Questions About Inflation’s Business Impact

▼

Inflation primarily affects business costs by increasing raw material prices, labor expenses due to demands for higher wages, and rising utility and transportation costs. These direct and indirect increases erode profit margins unless actively managed and mitigated through strategic adjustments in operations and pricing.

▼

Protecting supply chains involves diversifying suppliers to reduce dependence, negotiating long-term contracts with fixed or indexed pricing, and exploring localized sourcing to minimize transportation costs and lead times. Building strong, collaborative relationships with key suppliers also helps in navigating price pressures effectively.

▼

Mitigating labor costs involves strategic wage adjustments, often focusing on performance-based incentives rather than broad increases. Enhancing non-monetary benefits like flexible work, professional development, and improving operational efficiency through technology and process optimization can also offset rising payroll expenses by boosting productivity.

▼

Businesses should adopt dynamic pricing models, consider value-based pricing, and explore product bundling. Crucially, transparent communication with customers about price increases is essential to maintain trust. Focusing on delivering exceptional value and fostering strong customer relationships can help retain a loyal customer base despite higher prices.

▼

Financial planning is critical because inflation erodes cash value and increases working capital needs. Robust cash flow forecasting, efficient working capital management, and strategic debt management are vital. These practices ensure liquidity, help control financing costs, and position the business to make wise investment decisions despite economic volatility.

Conclusion

The intricate dance between inflation and business costs is a constant challenge, yet it is one that can be navigated with foresight, strategic planning, and adaptive execution. By understanding the multifaceted ways inflation impacts everything from raw materials and labor to operational efficiency and consumer spending, businesses can implement targeted mitigation strategies. From fortifying supply chains and optimizing internal processes to carefully adjusting pricing and meticulously managing finances, the path to resilience lies in proactive measures. Maintaining an unwavering focus on long-term growth and fostering innovation, even amidst economic turbulence, equips businesses not just to survive, but to emerge stronger and more competitive in an ever-evolving market landscape.