Decoding Fed Rate Adjustments: A Business Owner’s Guide

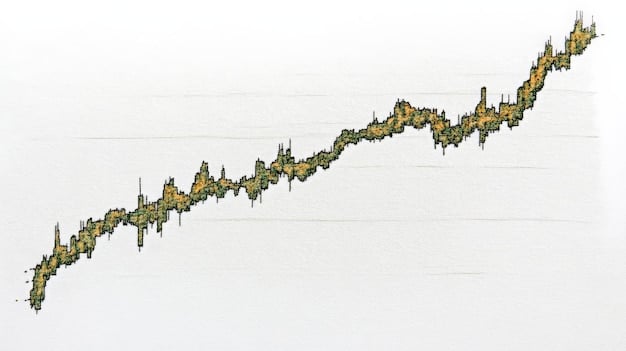

Decoding the Latest Federal Reserve Interest Rate Adjustments: A Business Owner’s Guide explains how recent changes to the federal funds rate impact borrowing costs, investment strategies, and overall business financial planning for entrepreneurs and business owners in the U.S.

Navigating the complexities of the financial world can be daunting for any business owner. Understanding the implications of decoding the Latest Federal Reserve Interest Rate Adjustments: A Business Owner’s Guide is crucial for making informed decisions about your company’s financial future.

Understanding the Federal Reserve’s Role

The Federal Reserve, often referred to as the Fed, plays a pivotal role in the U.S. economy. Its primary mission is to maintain stable prices and maximize employment. One of the key tools it uses to achieve these goals is adjusting the federal funds rate.

Understanding this role is crucial for business owners trying to navigate the economic landscape.

The Fed’s Dual Mandate

The Fed operates under a “dual mandate,” meaning it aims to achieve two coequal objectives: price stability and maximum employment. This balancing act is often challenging, as policies designed to support one goal can sometimes negatively impact the other.

How the Fed Influences Interest Rates

The Fed influences interest rates primarily through the federal funds rate. This is the target rate that commercial banks charge one another for the overnight lending of reserves. By raising or lowering this rate, the Fed can influence the cost of borrowing throughout the economy.

- Open Market Operations: Buying and selling government securities to influence the money supply and short-term interest rates.

- The Discount Rate: The interest rate at which commercial banks can borrow money directly from the Fed.

- Reserve Requirements: The fraction of a bank’s deposits that they are required to keep in their account at the Fed or as vault cash.

The Federal Reserve’s influence on interest rates is a critical factor for business owners to monitor, as it directly impacts borrowing costs, investment decisions, and overall economic activity.

Decoding Interest Rate Hikes

When the Fed raises interest rates, it’s essential for business owners to understand the potential consequences. Higher interest rates can impact various aspects of a business, from borrowing costs to consumer spending.

Let’s explore the implications of these hikes in detail.

Impact on Borrowing Costs

One of the most immediate effects of a rate hike is an increase in borrowing costs. This means that loans for capital expenditures, expansion, or even day-to-day operations become more expensive. Businesses with variable-rate loans are particularly vulnerable.

Effects on Consumer Spending

Higher interest rates can also dampen consumer spending. As borrowing becomes more expensive for consumers, they may reduce their spending on goods and services, which can impact business revenues, especially for businesses oriented towards retail or discretionary spending.

An environment of reduced spending can impact a business’s cash flow, profitability, and growth prospects.

- Reduced Demand: Higher rates often lead to decreased demand for products and services.

- Inventory Management: Businesses may need to adjust their inventory levels to avoid excess stock.

- Pricing Strategies: Companies might need to rethink their pricing strategies to remain competitive in a tighter market.

Understanding and adapting to these shifts in consumer behavior is crucial for weathering the storm during periods of rising interest rates.

Understanding Interest Rate Cuts

Just as rate hikes have a specific impact, interest rate cuts also carry significant implications for businesses. These cuts are often implemented to stimulate economic growth, but their effects are multifaceted.

Let’s examine what rate cuts can mean for your business.

Benefits of Lower Borrowing Costs

Lower interest rates directly translate to reduced borrowing costs. This can make it more affordable for businesses to secure loans for investments, expansions, or even refinancing existing debt. It is especially helpful for businesses looking to expand or invest in new equipment.

Stimulating Investment and Growth

Rate cuts are intended to spur investment and economic growth. As borrowing costs decrease, businesses are more likely to invest in new projects, hire additional staff, and expand their operations. This can lead to increased productivity and profitability.

Low interest rates can also encourage businesses to take calculated risks, fostering innovation and creating new opportunities.

- Capital Investments: Lower rates can make large capital investments more feasible.

- Mergers and Acquisitions: Reduced borrowing costs can facilitate mergers and acquisitions.

- Research and Development: More funds may be allocated to research and development initiatives.

Strategies for Adapting to Rate Changes

Regardless of whether interest rates are rising or falling, business owners need to be proactive in adapting their strategies to maintain financial stability and capitalize on new opportunities.

Smart adaptation is key to thriving in any economic environment.

Refinancing Debt

When interest rates fall, it may be an opportune time to refinance existing debt. Refinancing can lower your monthly payments, reduce your overall interest expenses, and free up cash flow for other business needs. Businesses should always monitor interest rate trends and explore refinancing options when rates decline.

Managing Cash Flow

Effective cash flow management is always important, but it becomes especially critical during periods of interest rate volatility. Closely monitor your accounts receivable and accounts payable, and consider implementing strategies to accelerate collections and extend payment terms where possible.

Proper cash flow management involves strategies like maintaining a healthy reserve and creating contingency plans.

- Budgeting: Creating a detailed budget to track income and expenses.

- Forecasting: Predicting future cash inflows and outflows to anticipate potential shortfalls.

- Contingency Planning: Establishing strategies to address unexpected financial challenges.

The Impact on Different Industries

The effect of interest rate adjustments can vary significantly depending on the industry. Understanding how your specific sector is likely to be impacted can help you tailor your strategies more effectively.

Different industries react differently to rate adjustments.

Real Estate and Construction

The real estate and construction industries are particularly sensitive to interest rate changes. Higher rates can reduce demand for new homes and construction projects, while lower rates can stimulate growth in these sectors. Therefore, businesses in these fields should pay close attention to interest rate trends and adjust their project pipelines accordingly.

Manufacturing

Manufacturing companies often rely on borrowing to finance capital expenditures and inventory. Higher interest rates can increase their production costs and reduce their competitiveness, while lower rates can make it easier to invest in new equipment and expand their operations. Efficient supply chain management and cost optimization are vital strategies for manufacturers during times of rate volatility.

With rising interest rates being a great concern for manufacturers, keeping an eye on any governmental support or subsidies can drastically help the businesses survive.

- Supply Chain Optimization: Streamlining supply chains to reduce costs and improve efficiency.

- Technological Upgrades: Investing in technology to automate processes and increase productivity.

- Diversification: Expanding into new markets or product lines to reduce dependence on specific sectors.

Future Outlook and Predictions

Predicting the future course of interest rates is a complex task, but staying informed about economic forecasts and Fed communications can help business owners anticipate potential changes and prepare accordingly.

Careful analysis and preparation can pay off handsomely.

Monitoring Economic Indicators

Keep a close watch on key economic indicators such as gross domestic product (GDP) growth, inflation rates, unemployment figures, and consumer confidence indices. These indicators can provide valuable insights into the health of the economy and the likely direction of interest rates.

Staying Informed About Fed Communications

Pay attention to statements and speeches from Fed officials, as well as the minutes of Federal Open Market Committee (FOMC) meetings. These communications often provide clues about the Fed’s thinking and its likely policy moves. In the digital age there is no reason not to keep up with the Fed’s current communications and announcements.

Furthermore, attending industry events and conferences can provide additional perspectives and insights from leading economists and financial experts.

- Consulting Financial Advisors: Seeking advice from qualified financial advisors can provide tailored guidance.

- Networking: Engaging with industry peers.

- Scenario Planning: Developing contingency plans in response to different rate scenarios.

| Key Aspect | Brief Description |

|---|---|

| 📈 Fed’s Role | Maintaining price stability and maximizing employment. |

| 💸 Rate Hikes | Increase borrowing costs, potentially slowing consumer spending. |

| 📉 Rate Cuts | Reduce borrowing costs, encouraging investment and growth. |

| ✨ Strategies | Refinancing debt,managing cash flow, and diversify investments can all have a huge impact. |

Frequently Asked Questions

▼

Fed rate adjustments directly impact the interest rates on small business loans, especially those with variable rates. Higher rates mean higher borrowing costs, affecting profitability and investment decisions.

▼

Businesses can refine existing debt, improve cash flow management, and diversify investments. Building strong customer relationships and exploring alternate sources of financial commitment, might also serve as a useful buffer.

▼

Interest rate cuts reduce borrowing costs for businesses, promoting investment in projects, hiring, and expansion. This boosts economic activity and can lead to increased productivity and profitability.

▼

Industries like real estate, construction, and manufacturing are especially sensitive to rate changes. Businesses in these sectors should closely monitor rate trends and adjust pipeline and project plans accordingly.

▼

Businesses can monitor key economic indicators with close detail like GDP Growth, inflation rates and also consumer confidence indexes. Staying in tune with news from the Fed is very helpful and reliable.

Conclusion

Understanding and adapting to the Federal Reserve’s interest rate adjustments is essential for business owners. By staying informed, managing cash flow effectively, and strategically planning for different scenarios, businesses can navigate the economic landscape with greater confidence and success.